Natural Gas Investment Strategies

Proprietary fundamental research and analytical models to identify short to intermediate-term mispricing and trading opportunities in the US Natural Gas market.

About me

Mikhail Malakhov

Energy Derivatives Trader

Experienced Energy Derivatives Trader with a demonstrated history of working in the financial services industry, expresses its view via outright price and calendar spreads and applies directional, relative value, and options strategies.

NATURAL GAS INVESTMENT STRATEGIES

Trader seeks to generate absolute returns by trading financial instruments associated with the US Natural Gas market.

The ROI target is to produce net 22% uncorrelated annualized returns while minimizing the risk of loss.

Discloser

THIS DOCUMENT IS ADDRESSED TO PROFESSIONAL AND WELL-INFORMED INVESTORS. IT GIVES A GENERAL IDEA OF FUNDAMENTAL TERMINOLOGY AND CONCEPTS; THE DOCUMENT’S CONTENT IS GENERAL AND IS NOT ADDRESSED TO ANY PARTICULAR INDIVIDUAL OR ENTITY.

About Me.

Experienced Energy Derivatives Trader with a demonstrated history of working in the financial services industry, expresses its view via outright price and calendar spreads and applies directional, relative value, and options strategies.

MBA in financial management, passed: CAIA, HKSI, CTA, going through CFA, FRM.

More than 10 years of experience in buy-side Derivatives for energy resources and Publicly Traded Energy Equities trading on exchanges around the world. Before Finartel Capital AIFLNP, headed the risk department at Bank “Otkritie”, worked for several hedge funds in APAC and EU.

Specialization: Derivatives for energy resources.

Strategies brief description

The core idea of our trading philosophy is to follow the sentiment of physical producers, consumers, hedgers, and speculators. Our approach is fully systematized and formalized. Decisions are based on segmenting the market into different phases and cycles, utilizing data from CFTC reports, EIA reports, volatility measures, weather and seasonal patterns, and real-time market data from energy exchanges worldwide.

All trading decisions are based on proprietary quantitative trading strategies.

NATURAL GAS DERIVATIVES STRATEGY ( 2016— Today )

Close to market-neutral spread trading program

Natural Gas Derivatives is a systematic commodity non-market-neutral program. It overlaps statistical arbitrage in nature, by calculating and identifying statistical mispricing in the forward curve of the Global Natural Gas energy futures markets. And same time can have directional exposure to the market through complex options combinations.

Trading signals are primarily a function of supply and demand dislocations driven by seasonality and weather conditions, implied storage costs, idiosyncratic events (e.g., price shocks), and increasing/realizing convenience yields. Historically, the returns of the Natural Gas Derivatives Program have been uncorrelated to the returns of other investments, including niche energy specialized CTAs.

ENERGY STOCKS/ETF STRATEGY ( 2018 — Today)

Natural gas physical negative rolling yield collection strategy.

Strategy idea – maintaining writing uncovered options on ETF:UNG on both sides. On each options expiration date to collect options premium from Theta in winning trades.

Source of trading model Alpha – based on historical observations 85% of the time Natural gas futures term structure is under of contango effect. And it creates a negative rolling yield with an average level of decline of 24% per year. This negative yield is decreasing the value of ETF: UNG.

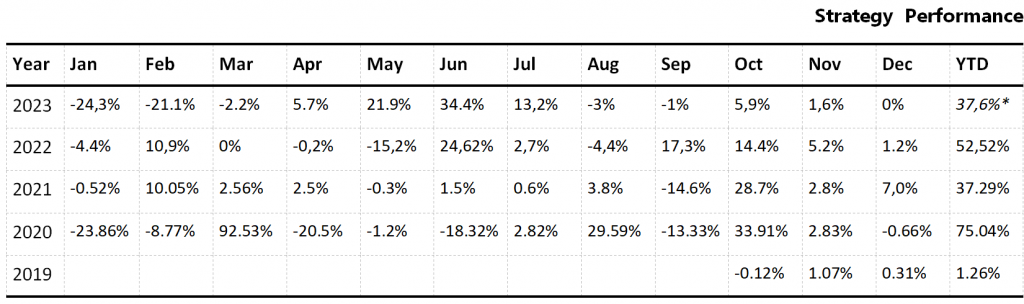

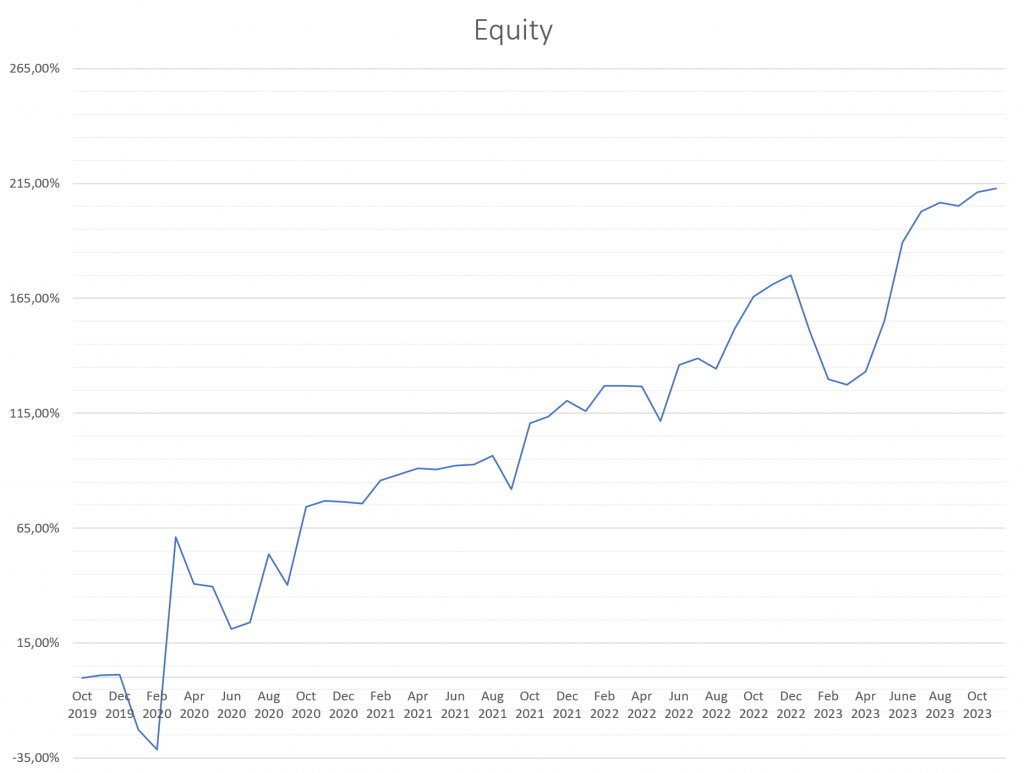

Live track record. It can validate it with brokerage statements. (Stonex, Interactive Brokers, Exante, FF, others)

Statistics

Basic risks: The risk of loss in trading futures is substantial. Therefore, it is mandatory to carefully consider whether such trading is suitable in the light of interested investor’s financial conditions. A potential loss cannot be determined in advance and can exceed any collateral (margin) posted. In considering whether to trade or to authorize someone to trade, interested investors should be aware of all risk factors as described in Disclosure Document which is available upon request.

Strategy Performance